Downloads

Keywords:

Determinants of Cash Holdings: Evidence from Listed Pharmaceutical Companies in Nigeria

Authors

Abstract

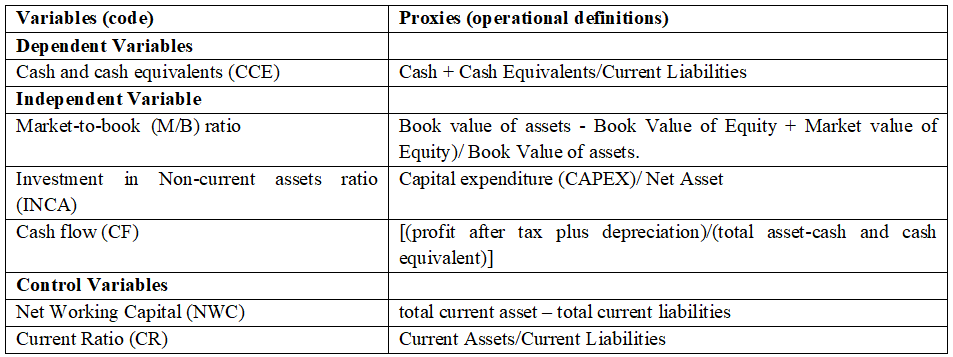

This study assessed the determinants of cash holdings of quoted pharmaceutical firms in Nigeria from 2014-2022. Three hypotheses were formulated in line with the objectives of the study. Ex-post facto research design and panel data were adopted and the data for the study were obtained from fact books, annual reports and account of the quoted pharmaceutical firms under study. Pearson coefficient of correlation and Panel least square regression were applied for the test of the three hypotheses formulated with aid of E-View 9.0 statistical software. Findings showed that market-to-book value ratio, investment in non-current assets and cash flow have a significant but negative significant relationship with cash holding (proxied by cash and cash equivalent) at 5% significant level. Based on these findings, the study recommended among others that pharmaceutical firms should adopt cash management practices since cash reduces the burden to perform well and allows managers to invest in projects that best suit their own interests.