Downloads

Keywords:

The Role of Industry Type, Firm Age, And Market Dynamics on The Relationship Between Entrepreneurial Orientation and The Performance of The Elite Companies (Ghana Club 100) In Ghana

Authors

Abstract

Purpose: In Ghana, the Ghana Investment Promotion Centre (GIPC) annually ranks the top 100 firms—known as the Ghana Club 100—based on criteria such as size, growth, profitability, and corporate social responsibility. These companies are often viewed as market leaders, playing a pivotal role in Ghana’s socio-economic development through employment creation, innovation, and revenue generation. However, despite their elite status, there is growing recognition that not all firms within the Ghana Club 100 sustain high performance consistently, especially amid volatile macroeconomic conditions such as currency depreciation, inflationary pressures, and disruptions from global events like the COVID-19 pandemic.

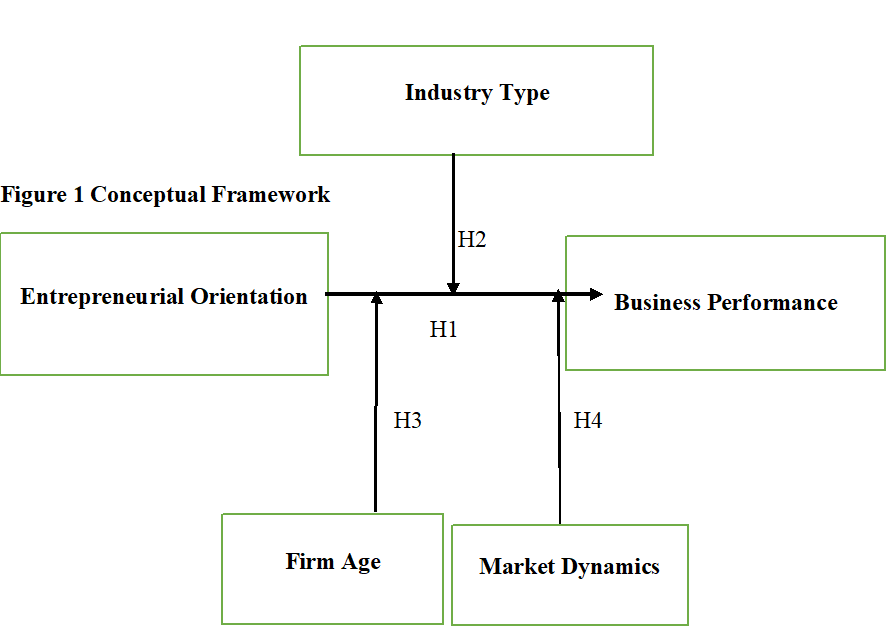

Methodology: This study employs the quota sampling technique to select a representative sample of 215 firms from the Ghana Club 100. The study also adopted an explanatory research design to investigate the role of industry type, firm age, and market dynamics on the relationship between entrepreneurial orientation (EO) and business performance among elite firms listed in the Ghana Club 100.

Findings: The findings of this study offer compelling evidence that Entrepreneurial Orientation (EO) exerts a positive and significant influence on Business Performance among elite firms in Ghana. Moreover, the results reveal that the relationship between EO and Business Performance is significantly moderated by Industry Type, Firm Age, and Market Dynamics.

Unique Contribution to theory, policy and practice: Specifically, Industry Type positively moderates the relationship, suggesting that the strength of EO’s impact on performance varies across different sectors, with some industries benefiting more from entrepreneurial behaviors than others. Similarly, Firm Age also positively moderates this relationship, indicating that more mature firms may be better positioned to leverage their accumulated experience and resources in applying entrepreneurial strategies effectively. Finally, Market Dynamics positively moderate the EO–performance linkage, emphasizing that firms operating in highly dynamic and volatile markets gain greater performance benefits from entrepreneurial orientation, consistent with the tenets of Dynamic Capability Theory. The study affirms that Entrepreneurial Orientation is a key strategic posture for enhancing business performance, and its effectiveness is contingent on contextual factors such as industry environment, organizational maturity, and external market conditions. These insights highlight the importance for managers and policymakers to align entrepreneurial strategies with organizational and environmental realities to achieve optimal performance outcomes.